30-second summary:

- Publicis Sapient and Google Cloud partnered with Ipsos to create The Data Collection & Consent Survey (DCCS).

- 5000 people across five countries — Great Britain, France, Germany, the U.S., and Australia – participated in the survey.

- The goal of the survey was to better understand what people know, feel, and want when it comes to corporate data collection and sensitivities around data privacy.

- The Publicis Sapient survey drilled down into data sentiment within nine industries, including retail, financial services, health services, and consumer products.

- To get a deeper understanding of each country’s findings, including a wealth of statistics and charts, download the complete report from ClickZ.

Publicis Sapient and Google Cloud recently partnered with Ipsos to create The Data Collection & Consent Survey The goal of the survey was to better understand what people know, feel, and want when it comes to corporate data collection.

In this post, we’ll unpack some of the key findings and data points from the survey. You can download the entire report, The Data Collection & Consent Survey, here.

Content produced in partnership with Publicis Sapient.

A positive outlook on technology, a negative view of data collection

The majority of those surveyed felt that technology has a positive impact on their personal lives, though this was more overwhelmingly the case in the U.S., Great Britain, and Australia. France and Germany took a more neutral stance.

When it comes to data privacy, however, the sentiment wasn’t as positive. While 75% of American respondents believe it’s possible to have data privacy in today’s technology-driven world, a significant portion of respondents (Read more...) in five) worry about being able to maintain their privacy while online.

That worry is present across all five countries included in the survey, with roughly half of respondents feeling negative about the data collected about them.

“Despite their belief that technology has a positive effect on people’s lives, the majority worry that the data companies collect on them can be harmful and feel their data is worth more than the free services they receive in exchange,” writes Publicis Sapient.

In order to make people feel better about giving you their data, you have to build trust.

Counterintuitively, data control increases brand trust

Building trust may sound simple enough, but there’s more to it than simply notifying people about your data practices and getting consent.

The results of the survey showed that people want nuanced control over their data. U.S. consumers, in particular, placed the highest trust in companies that allow them to manipulate their own data.

Over 70% of U.S. respondents said they were more likely to do business with a company if they were offered the opportunity to delete their information. U.S. consumers also valued the ability to turn off location tracking, delete their browsing history, choose whom a company shares information with, and review the information that companies have about them.

Per the report: “Companies that prove themselves to be trustworthy and responsible in their dealings with personal data will have a better reputation and ultimately attract more customers.”

Another key finding: about 40% of respondents, regardless of country, felt that their data is worth more than the free services they receive in exchange.

The report includes specifics on the type of data people are willing to exchange (or not) based on different industries and services — for example, 76% of American respondents were unwilling to share their banking information in order to get help with their home budget. The type of information people are willing to freely share varies based on the country.

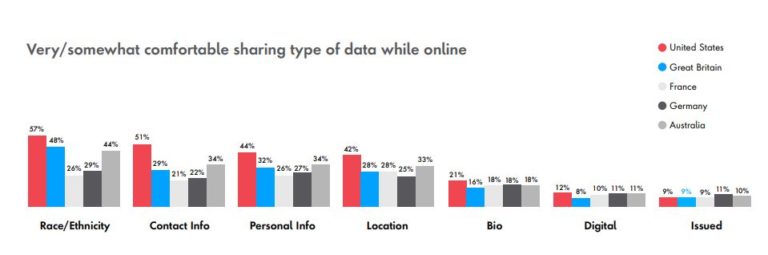

As the above chart illustrates, Americans, Britons, and Australians are much more likely than the French or Germans to share race/ethnicity, contact info, personal info, and location.

Data sharing by industry

The survey drilled down into data sentiment within nine industries including retail, financial services, health services, and consumer products. There are too many insights about consumer sentiment surrounding data privacy and sharing by industry to list here, but top takeaways include:

- Finance: About 50% of Americans share personal data online or in apps with financial service companies

- Healthcare: About 70% of Australians, Britons, and Americans are willing to share their personal and contact information with healthcare companies while online/in apps

- CPG: 58% of French respondents were not willing to share any personal data with CPG companies while online/in apps, versus 47% of Americans and 43% of Britons and Australians

- Retail: About half of Australians, Americans, and Britons and a third of French and Germans are willing to share their contact information with retail companies while online/in apps

Other industries included in the report are Food Delivery & Restaurants, Transportation, Travel & Hospitality, and Technology/Media/Telecom, Government and Generic Services.

Better communication is the key to better data

Publicis Sapient stresses that clear communication about why a company is collecting data and how they plan to use it is important for improving relationships with customers. Clear communication builds trust. Informed consumers feel more confident with sharing their valuable information. This is clearly an area where companies can improve, regardless of country.

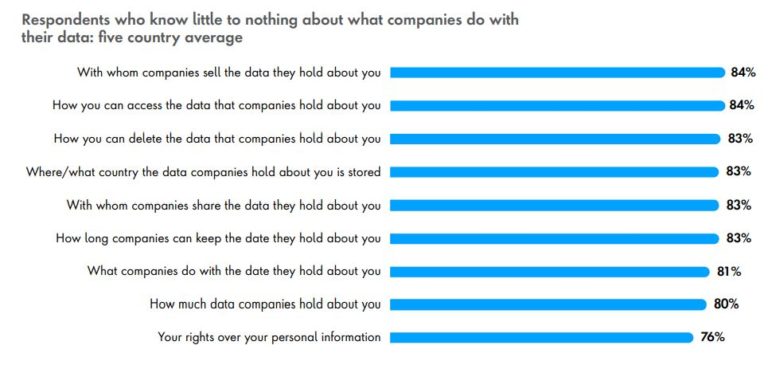

Publicis Sapient writes, “On average, four in five people in all five countries say they know little to nothing about what companies do with the data they collect.”

The majority (80+ percent) of consumers didn’t know about nine key data topics as shown in the following chart.

Using the nine topics above, Publicis Sapient developed a single measurement of people’s knowledge of what companies do with their data. The report contains a breakdown of this data knowledge index by country, and further breaks it down by sex and age group (Gen Z through Baby Boomers).

Understanding what kind of data presents the most concern for individuals, which sectors consumers are most worried about sharing information with, and the nuances of how consumers view data sharing based on country, age, and demographic can help you formulate a comprehensive data collection and consent strategy.

To get a deeper understanding of each country’s findings, including a wealth of additional statistics and charts, download the complete report, The Data Collection & Consent Survey.