This morning, Merkle released its quarterly Direct Marketing Report, ahead of Google’s own Q2 earnings announcement and it makes for a bumper stat-filled reading.

Of particular note are the revelations that:

- Google search spending growth has slowed to 22% as CPCs fall 9%

- Desktop PLA growth rate jumps while mobile growth is strong but slowing

- Shopping Ads traffic from Google image search and Yahoo surges

- Google’s expanded text ads have had only a modest impact

The full report (registration needed) covers the latest trends in paid search, organic search, social media, display advertising, and comparison shopping engines, so let’s cherry-pick some of the highlights…

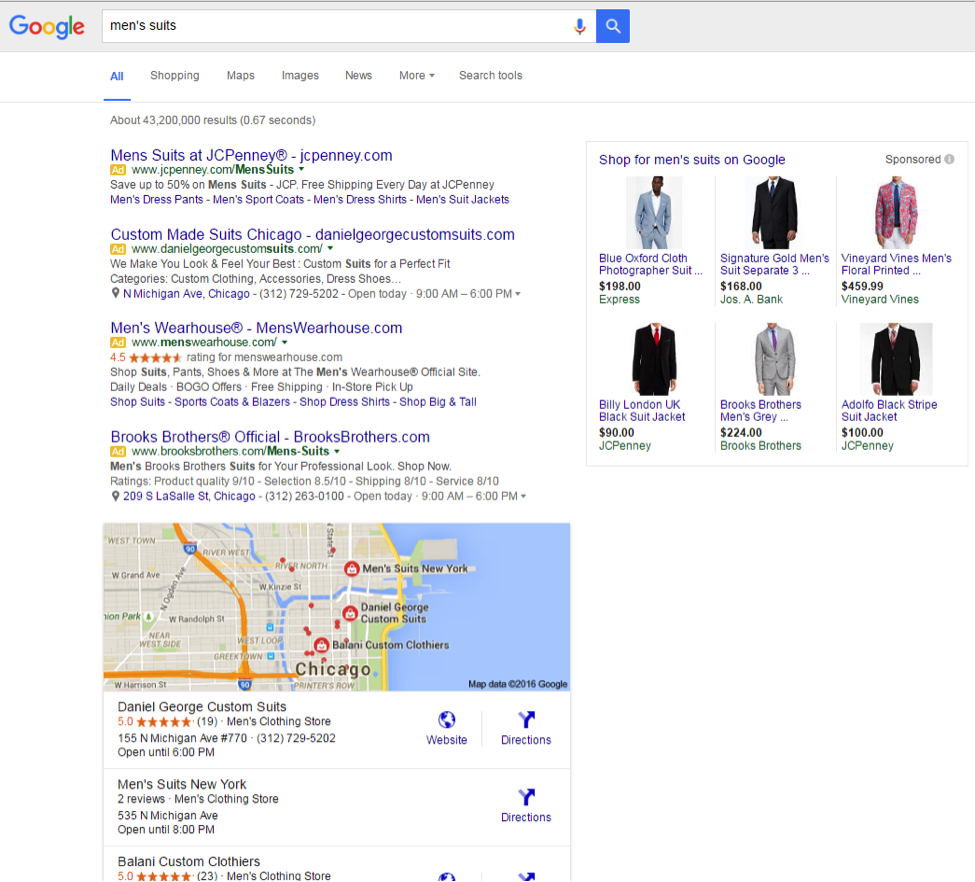

Paid Search

- Advertiser spending on Google paid search grew 22% Y/Y in Q2 2016, a slight deceleration from 25% growth in Q1.

- Click growth increased slightly to 34%, but CPCs fell 9%.

- Spending growth for Google text ads slowed to 10% Y/Y as CPC growth for brand keywords fell from 10% in Q1 to 0% in Q2.

- Google Shopping Ad spending growth rose to 43% as an influx of partner traffic bolstered total click volume.

- Combined spending on Bing Ads and Yahoo Gemini search ads fell 17% Y/Y as click declines continued to worsen.

- Bing Product Ad spending fell for the first time since the format’s launch, likely the result of Yahoo moving to show more Google PLAs.

- Phones and tablets produced 53% of all paid search clicks in Q2, the same rate as a quarter earlier, but up 12 points from a year earlier. Google’s share of clicks from mobile increased slightly to just over 57%

Organic Search & Social

- Organic search visits fell 7% Y/Y in Q2, down from 11% Y/Y growth a year earlier, as organic listings face increased competition from paid search ads, particularly on mobile.

- Mobile’s share of organic search visits rose to 46%, (Read more...) that still lags behind the 53% of paid search clicks that mobile produces, as well as the 47% share that mobile produced for organic search a year ago.

- Google produced 86% of all organic search visits in the US and 90% of mobile organic search visits.

- Google’s share of mobile organic search has increased by nearly two points in the past year.

- Social media sites accounted for 2.8% of site visits in Q2 2016, with Facebook producing 63% of all site visits driven by social media.

Comparison Shopping Engines

- The eBay Commerce Network commanded a majority of advertisers’ comparison shopping engine (CSE) spending for the first time in Q2. Along with Connexity, the two dominant CSE platforms accounted for 97% of all CSE ad spending.

- Advertiser revenue produced by eBay Commerce Network and Connexity listings grew by 33% and 23% Y/Y respectively; however, the two platforms combined for less than 10% of the revenue produced by Google Shopping Ads, among advertisers participating in all three platforms.

Display Advertising

- Total display advertising spending grew 62% Y/Y, driven by very strong results from Facebook, where Merkle advertisers increased their investment by 121% Y/Y.

- Retargeting accounted for 62% of all display spending in Q2.

- The Google Display Network (GDN) also delivered spending growth, with advertisers seeing its share of total Google ad spending increase to 12%.

Related reading

With more than a billion users, and billions of daily video views, gaining users’s attention on YouTube may seem a daunting prospect. ... read more

SEO, SEM, PPC, CTR, HTML, HTTP, IP… even for the most seasoned digital marketing professionals, the world of SEO can be a ... read more

It’s been a great year for Snapchat and it’s no surprise that Facebook is eyeing up many of its most successful features. ... read more

Sometimes the functionality and user experience (UX) on a website can make or break a business. Things like mobile optimization or page ... read more