30-second summary:

- Sellercloud is an omnichannel ecommerce growth platform that provides merchants with a range of tools to help them navigate the ecommerce landscape.

- In a new white paper, Sellercloud notes several promising post-pandemic ecommerce trends, including consumers’ willingness to branch out into smaller marketplaces and seek out D2C options in their search for goods.

- With 73-80% of consumers surveyed willing to maintain their new shopping habits, ecommerce businesses have an unprecedented opportunity to blend 1P and 3P channels for optimal growth.

- The Sellercloud Annual Trends and First Party Ecommerce Growth Report is available in its entirety on ClickZ.

Headquartered in Lakewood, NJ, Sellercloud is an omnichannel ecommerce growth platform that provides merchants with a range of tools to help navigate the ecommerce landscape.

In a recently published white paper, Sellercloud provides an overview of post-pandemic shopping patterns driven by consumers and explains why an omnichannel ecommerce approach that incorporates both 1P and 3P channels is a promising growth strategy for retailers.

In this post, we’ll list a few key takeaways from the Sellercloud report, including some intriguing statistics from over 600 Sellercloud accounts. However, this is just a sneak peak of a very comprehensive report.

To get the full picture, download The Sellercloud Annual Trends and First Party Ecommerce Growth Report in its entirety from here.

Content created in partnership with Sellercloud.

Long term shifts in consumer shopping habits

Online spending reached $82.5 billion in May of 2020, a 77% year-over-year increase. This was one obvious impact of the pandemic, as people sought ways to safely shop while minimizing exposure to the virus.

Sellercloud notes that this level of (Read more...) would normally take 4-6 years to achieve. Growth was driven by an omnichannel approach, with consumers using multiple channels to make purchases.

Sellercloud writes, “As larger marketplaces like Amazon (namely products shipped through its Fulfillment by Amazon service) and Walmart faced unprecedented fulfillment delays, online shoppers demonstrated an increased willingness to branch out into other marketplaces – including seeking out direct-to-consumer (D2C) options.”

Since the start of the pandemic, consumers have been more willing to make online purchases, driven by store closings, concerns about safety, and depleted stock levels. Sellercloud notes that 73-80% of consumers surveyed plan to maintain their new shopping habits.

D2C opportunities increase thanks to ecommerce boom

Based on internal data, Sellercloud found that smaller marketplaces and 1P sales channels experienced significant order increases in Q3 2020 compared with 2018 and 2019.

Etsy, an independent seller marketplace, saw total orders spike by 384% for Sellercloud users from Q3 2019-2020. Other marketplaces including Overstock and Wayfair, as shown in the chart below, also experienced significant YOY growth from 2019 to 2020 despite experiencing a drop in orders in previous years.

Sellercloud’s data demonstrates the clear benefit that shifting shopping behaviors had for retail players that aren’t Amazon and Walmart.

Smaller marketplaces and 1P sellers like Kohl’s, Etsy, Wayfair, and Bed Bath & Beyond, all saw positive gains in orders as well as gross market value (GMV). Etsy’s GMV grew by 443% in Q3 2020 versus 2019 for Sellercloud accounts, after experiencing very minimal growth from 2018 to 2019.

The overall trend is a positive one—an ecommerce boom that promises to endure throughout 2021 and continue once the pandemic has ended.

Sellercloud writes, “As customers continue to expand their purchasing horizons, 1P and 3P channels of all sizes are proving that they can bring real value as part of an omnichannel sales strategy. This moment represents a crucial opportunity for sellers to capitalize on.”

Amazon’s and Walmart’s 1P and 3P channels also saw growth

Amazon and Walmart offer 1P and 3P options for sellers, and Sellercloud’s white paper touches on each option available and what this means for vendors. As with the smaller marketplaces noted above, both companies saw tremendous YOY growth from 2019 to 2020, with Walmart DSV (a 1P dropship sales program) achieving YOY growth of 204% in 2020.

Sellercloud notes that dropshipping continues to grow in viability throughout the pandemic, with the dropshipping market projected to reach over $591 billion annually by 2027, up from $44 billion in 2019.

“For many sellers, dropshipping – whether through the opportunities afforded by Walmart and Amazon or through other, smaller marketplaces – is proving to be a growing and profitable addition to a multi-channel ecommerce business plan,” explains Sellercloud.

The importance of adding 1P options to a multi-channel ecommerce strategy

There are many options for retailers to expand their 1P channels—from marketplaces like Overstock and Wayfair, to dropshipping opportunities on 3P marketplaces like Walmart, to adding a shopping cart to your website.

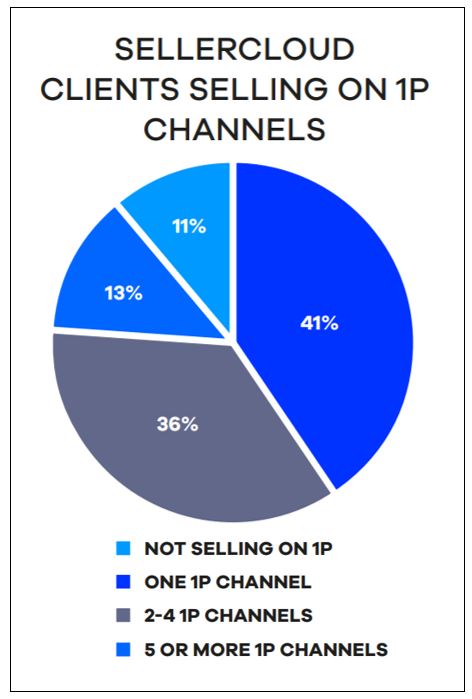

41% of Sellercloud’s clients are using at least one 1P channel, while fully 36% are using 2-4 1P channels to grow their first-party sales presence.

Customers have shown an unprecedented willingness to change their shopping behaviors, branching out beyond the largest marketplaces as they seek creative ways to shop. With this behavior unlikely to change, Sellercloud’s advice to retailers is to diversify by blending 1P and 3P channels into a reliable omnichannel strategy.