30-second summary:

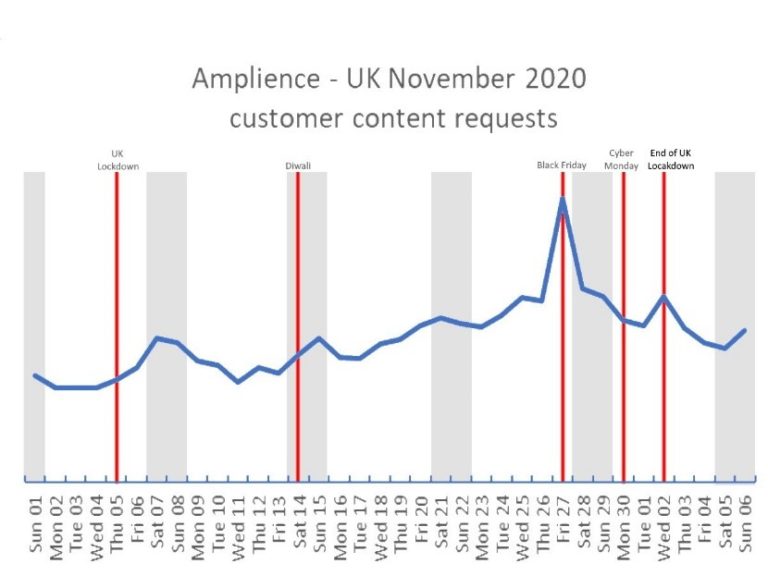

- Lockdown has had an enormous impact on browsing habits. Data indicates the flux in ecommerce or online shopping from the beginning of the November lockdown in the UK through to an unexpected peak as lockdown finished.

- Festivals and events – everything from Diwali to the launch of next-gen games – that would ordinarily propel shoppers into stores, have created short, sharp rises in online activity.

- The promotions normally focused on the Cyber Weekend have been extended this year across an entire month to take advantage of a rise of around 38% in traffic volumes as more people browse digitally.

- What this means for the uncertain year ahead is that retailers need to be agile and able to react quickly to the latest changes in rules and guidance to ensure they meet consumer demands.

- Competing in a digital world is tough. The pandemic makes it tougher, but the data tells a story and if retailers pay attention, they will survive.

For anyone working in the ecommerce sector, it’s an annual ritual to wait with anticipation for traffic volumes during the peak period to be published. For obvious reasons, 2020 peak was likely to deliver a few surprises.

The curtailment of in-store shopping has significantly increased online traffic and with so many of the bigger retailers opting to keep stores closed on Black Friday, there was potential for traffic volumes to be skewed to an even greater degree.

The consumer behaviors registered by vendors across their platforms, or by online retail indexes have shaped retail decision making for years. November is always a big volume month, but who could have anticipated quite how big it would be?

According to the IMRG (Read more...) Online Retail Index, which tracks the online performance of over 200 retailers, sales in November rocketed up to a 39% year-on-year rise. This was a +58% growth from October as well as an increase on the three-month rolling average of 34%.

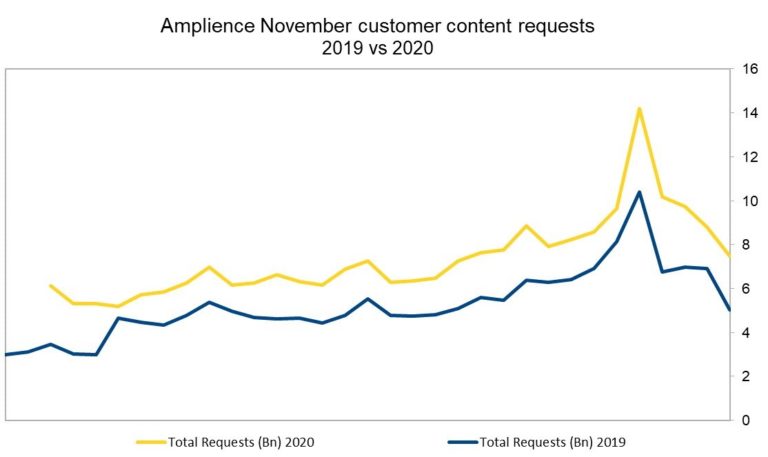

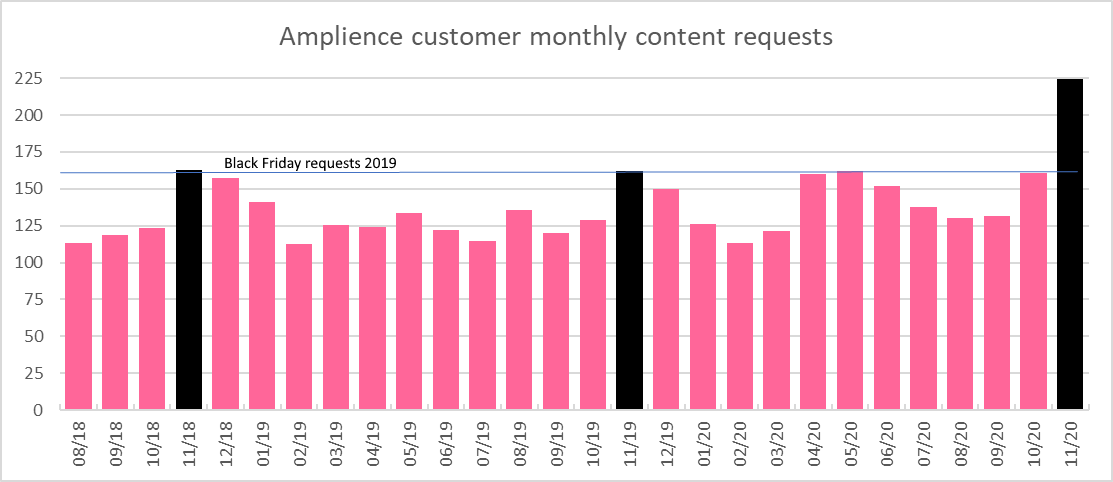

Weighing these figures up against traffic on our ecommerce platform, there is a remarkable correlation. Traffic was up a record 38% to 224bn requests from 162bn in 2019. The chart below shows that the pattern of traffic is consistent with last years’ but significantly amplified by the current situation.

We measure traffic by the number of content objects requested. On Black Friday alone, 14 billion(bn) content objects were delivered globally, totaling 545 terabytes (TB) of data. This was an increase of 35% from 2019.

At one point during the day, this reached 308,000 requests per second which equates to everyone in five packed football stadiums simultaneously making a content request every second.

Over the course of 10 days, objects delivered were at 96 billion, with a whopping total bandwidth of 3,600 (TB) equivalent to 20 years’ worth of 4k Video.

No celebration? Let’s shop online

Obviously, peak pushes volumes, but the comparisons in these figures provide a snapshot of the incredible impact that lockdown has had on ecommerce in general.

Festivals and holidays, for example, have been muted, if celebrated at all, and this is affecting online shopping. On Saturday the 14th of November, the Diwali festival, which would ordinarily see families gathering in large numbers in their homes, was drastically reduced.

This may have gone some way to explaining why online traffic volumes increased unexpectedly. It is also an important indicator for retailers who are currently considering the traditional Boxing Day sales in physical stores.

Other events have also produced peak volumes. The launch of Sony’s Playstation 5 on Thursday 12th November which was available online only saw a sharp rise in online activity, and units sold out almost instantly.

Meanwhile online events, such as Singles Day which ran for four days for the first time this year, hit an all-time high in volumes with brands handling 583,000 orders per second according to Alibaba.

On our platform it’s interesting to see the stark difference in numbers when you compare the November figures for the past two years. But even looking at the numbers for the start of the pandemic lockdown, it clearly shows traffic volumes increasing over April, May and June to a level of peak volumes of previous years.

The only anomaly in this was August where traffic was slightly lower than the last year which is likely to be because restrictions on travel and the removal of restrictions on physical shopping in many countries were temporarily lifted.

Conversely, in comparing volumes on our platform against retail data from the UK Office of National Statistics, it clearly shows that when shops reopened in the UK in June, retail sales increased by 13.8% but online traffic numbers grew too, indicating that some customers were eschewing a return to the high street and were compelled instead to purchase online.

We could even speculate that the events of this year have produced a permanent switch and digital will become the primary channel for shopping in the future.

Pandemic also changing device usage

In previous years we have seen traffic to mobile devices increase, with figures from Statista in March 2020 suggesting that ecommerce turnover from mobile devices would continue to soar.

However, since the pandemic restrictions, we have seen a change in how customers are consuming content. Desktop traffic moved up 6% to 37.11% of our traffic, and the likelihood is that working remotely at home is prompting shoppers to use their main device, while commuting, which has virtually stopped, would encourage more mobile shopping.

Media optimization

Although traffic has massively increased the throughput on our platform, bandwidth has not increased at the same rate. During peak, while volumes were up by 38%, object sizes on our platform were down by almost 2%.

This contrasts with the trend for bigger images due to new screen technologies. Between 2015-2018, image sizes increased by over 20%, but retailers and brands on our platform seem to be taking advantage of dynamic media to not only counter the need for larger images but to also optimize their overall page weight.

Summary

Against the backdrop of the global pandemic, this year has been remarkable for the ecommerce sector, and particularly during the peak period. Increasing traffic volumes and the growing sensitivity of traffic patterns in relation to offline events, points to digital becoming the primary channel, and an important factor for retailers planning their strategies for 2021.

The way that customers are consuming content indicates that understanding the digital channel mix is crucial. Delivering content and services using the right technologies will be essential for engaging with customers digitally, as the dominance of a single digital channel like mobile or desktop is becoming a thing of the past and content delivery is more distributed.