30-second summary:

- Two of the most prominent platforms in the social media scenario for ecommerce brands, TikTok and Snapchat, are reaching new heights when it comes to engaging with audiences

- As social media advertising budgets continue to rise, marketers must understand the specific strengths and weaknesses of both platforms to effectively allocate their resources for maximum brand awareness

- In the third edition of the ecommerce analysis series, ClickZ thought leader, Jamie Bolton, discusses the performance of the newcomers TikTok and Snapchat and how to optimize paid social strategies for optimum returns

In the third article of our series discussing the best channels, platforms, and strategies to win in ecommerce in 2023 and beyond, I focus on two of the most prominent platforms in the social media landscape: TikTok and Snapchat. Both platforms are known for their unique features, engaging content, and massive user base, which makes them valuable channels for ecommerce brands looking to reach and engage with their target audience.

Paid social channels have become one of the most effective ways for brands to reach and engage with their audience. As marketers continue to increase their investments in these channels, it’s crucial to understand how they can be measured using different metrics. In this article, we explore the performance of these two platforms, their strengths and weaknesses, and how ecommerce brands can use them to drive growth and increase revenue.

Understanding absolute versus relative ROAS

One important metric is the return on ad spend (ROAS), which can be measured using absolute and relative ROAS. Before we deep-dive into the details, let’s refresh on what these two terms mean in the ecommerce domain.

ROAS is a metric (Read more...) to evaluate the effectiveness of advertising campaigns. Absolute ROAS measures the amount of revenue generated by advertising spend, while relative ROAS considers a brand’s average performance and compares it to the performance of individual channels or platforms. Both metrics are important for measuring the success of advertising campaigns and determining which channels or platforms are performing well.

Analyzing the performance of Snapchat and TikTok

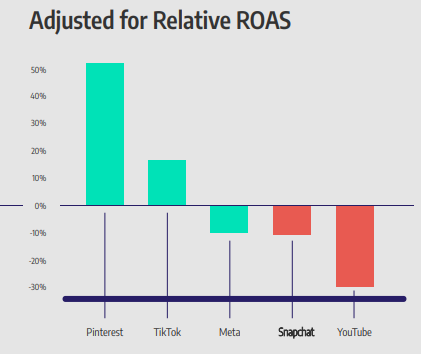

Snapchat and TikTok have both shown solid performance when measured using absolute ROAS. However, when viewed through the lens of relative ROAS, they fare very differently.

Snapchat’s performance drops to give it a very poor image indeed, while TikTok holds its performance and moves up the ranking to become the second strongest paid social platform. This is because Snapchat is predominantly used by high-performing brands but plays a passenger role in their mix, driving low ROAS relative to their averages. TikTok, on the other hand, is a strong player where it features but is typically favored by brands who accept a lower ROAS overall. These are likely to be disruptive brands prioritizing customer acquisition over profitability.

What happens when established, high-ROAS brands adopt TikTok?

One interesting question that arises is, “what happens when established, high-ROAS brands adopt TikTok at scale?” It’s possible that they could improve their performance on the platform, but it remains to be seen whether they will be able to achieve the same level of success as disruptive brands.

There is a chance that high-ROAS brands could struggle with TikTok because their focus on profitability may clash with the platform’s emphasis on customer acquisition. On the other hand, if they can adopt a more aggressive approach to customer acquisition, they may be able to succeed on the platform. This gives brand marketers something to think about their content strategy for TikTok to align with these insights.

Key takeaway

In conclusion, TikTok has emerged as a strong player in the paid social landscape, particularly for aggressive brands looking to prioritize customer acquisition. Snapchat, on the other hand, is predominantly used by high-performing brands but may not be the best option for brands looking to maximize their ROAS.

Brands should be aware that achieving strong performance can be difficult. By focusing on creating high-quality content that resonates with their audience, brands can improve their performance and maximize their ROI.

For senior marketers, it is important to understand the nuances of each platform and their respective strengths and weaknesses. By using these insights, brands can make better decisions about their paid social and YouTube strategies and ultimately improve their performance in these channels. To further navigate the challenge of measuring successes and pitfalls on different platforms, it would be worth considering marketing measurement platforms like Fospha to have one source of truth.

Are you looking for more insights into the DTC space? Join Fospha’s DTC Networking Club! The network helps marketers from top DTC brands meet up once a month to swap notes on ecommerce advertising strategies and the latest trends in the market. Sign up now and start making meaningful connections.

Jamie Bolton is a ClickZ Advisory Board Member and head of Growth at Fospha, a leading marketing measurement platform for ecommerce.

Subscribe to the ClickZ newsletter for insights on the evolving marketing landscape, performance marketing, customer experience, thought leadership, videos, podcasts, and more.