30-second summary:

- Software selection isn’t as difficult as it’s been made out to be – but you absolutely need a plan. Don’t wing it.

- The right software decision can drive your business forward. The wrong one could cost you significantly.

- Follow this simple 5-step plan to streamline the selection process, minimize risk, and maximize satisfaction.

- Don’t be afraid to seek guidance when negotiating a deal and finalizing contracts.

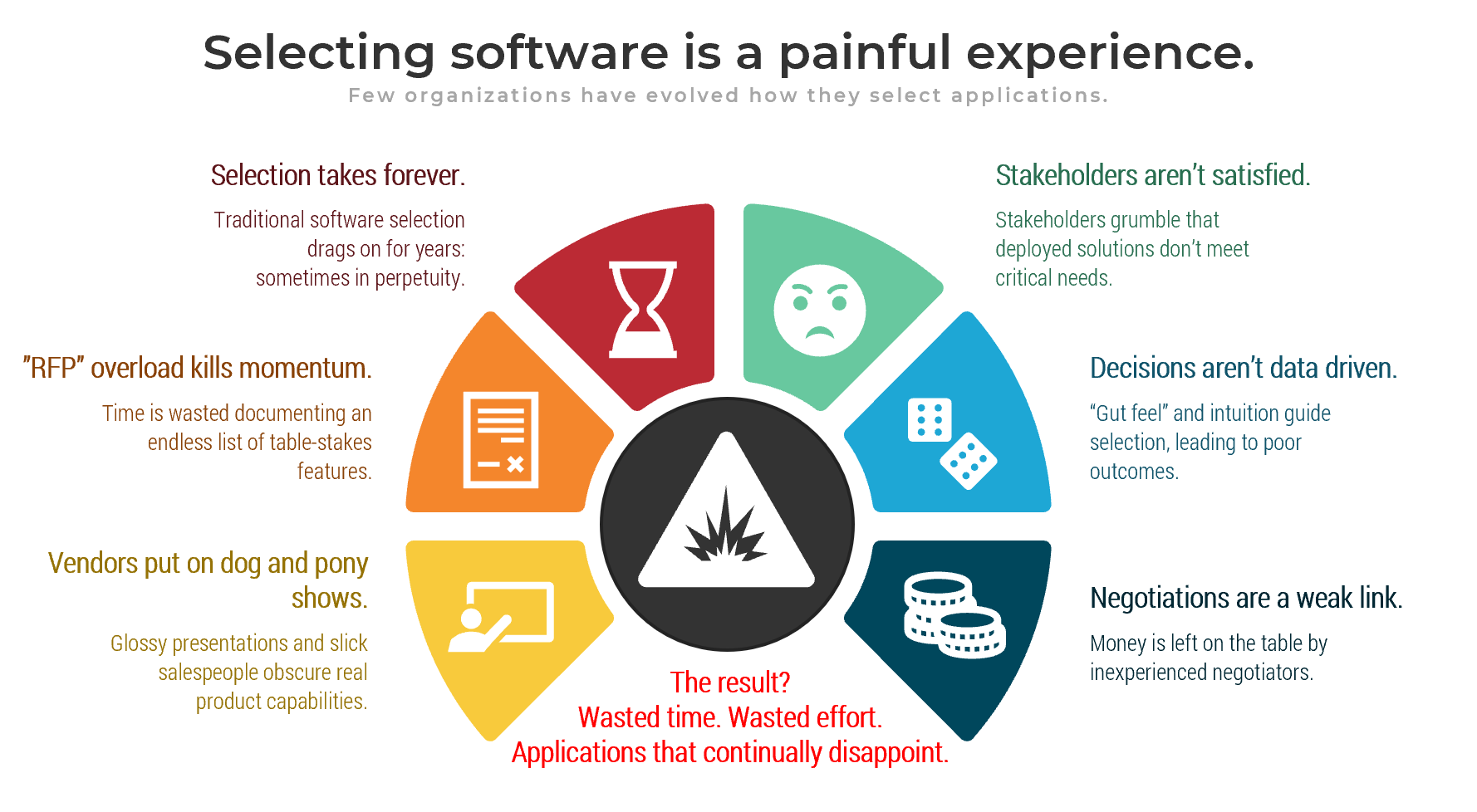

We’ve assumed since the beginning of digital time that choosing the right software package is difficult. It doesn’t have to be. But it is critically important. If you’re a marketer, you may be choosing a full-on CRM system, or a more focused online listening tool. Whatever you need, the very future of your organization may hinge on how successful the selection process is.

Chances are you’ve been winging it. If you’ve never done it before, you may not really know when to start when looking for new software. So you hit the internet to do some research without a plan in place.

For those of you who have been involved in a tool selection before, think back to the last software you selected. How straightforward was it? How long did it take? Were users satisfied? Is it solving all your needs? At the end of the day, did the implementation go well – and did it continue to do the job long after you first set everything up?

(Read more...) it’s been years since you first installed it, do you find yourself putting off renewal or replacement because you’re afraid of dealing with yet another cumbersome selection process?

As time goes by and you don’t renew software, you could be hurting your ability to meet business objectives more efficiently.

For some, this selection journey simply takes longer than it should, and choices come from a gut feeling or a personal bias rather than relying on data or looking at the business impact.

For others, a vendor may put on a dog and pony show, sell through a demo, and convince the buyer that, regardless of their situation, they are the only choice worth considering. Both scenarios end up with the same result – stakeholders aren’t happy, chances of the deployment going right are low, adoption rate is low, satisfaction rate is also low.

Source: Rapid Application Selection Framework, SoftwareReviews

But it doesn’t have to play out that way. Instead, allow me to introduce you to a straightforward, 5-phased – and repeatable – process that will help you streamline the way you select software. By following it, you’ll reduce the number of people involved, you’ll get it done in less than 30 days, you’ll increase satisfaction, and drive a higher adoption rate.

Phase 1: Awareness

Whether it was through your own research, personal bias, or from someone coming to tell you, somehow you figured out you needed software.

However you got here, this step should start by understanding “What does the business actually need and why?”

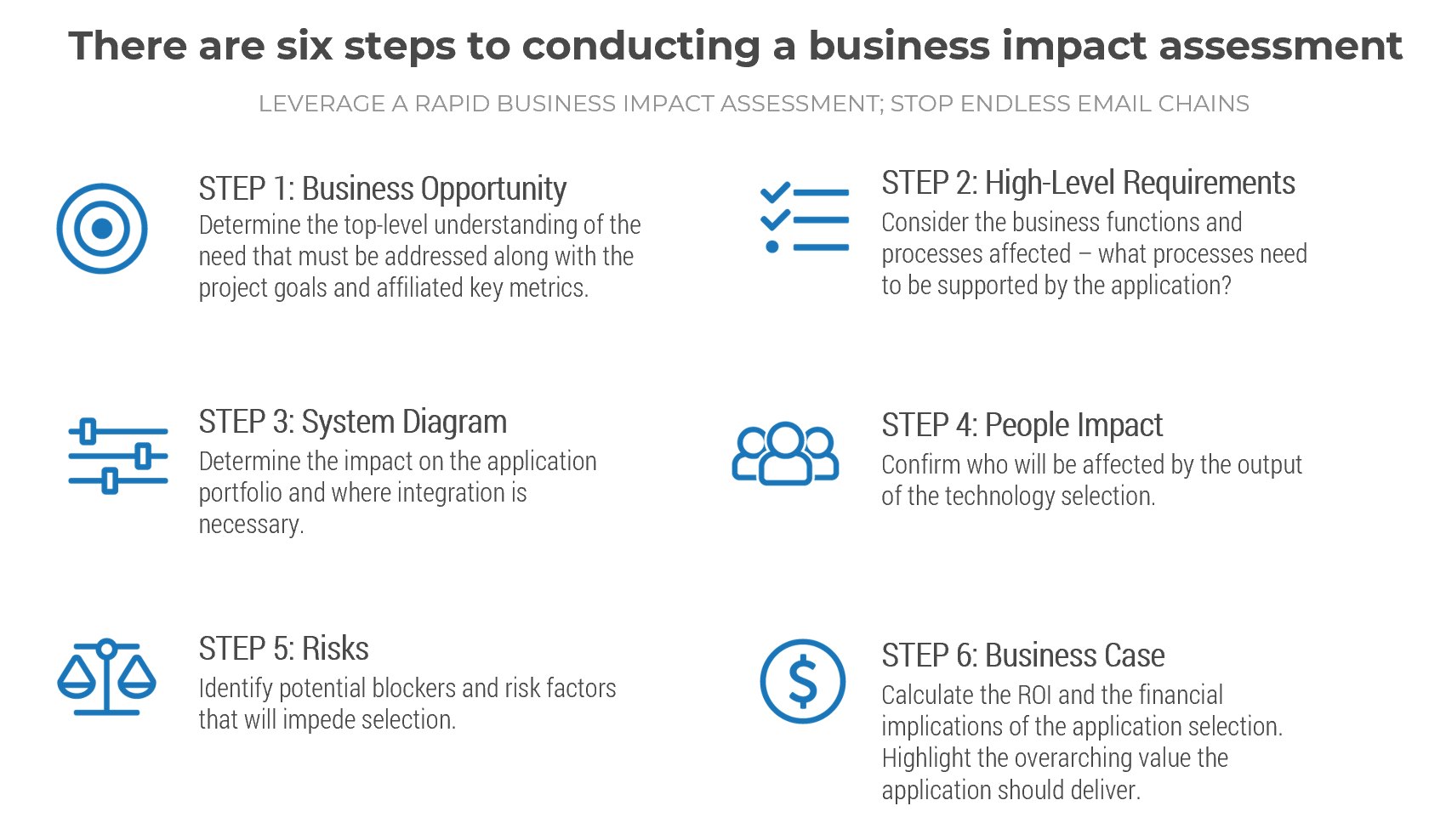

You can do this by completing a business impact assessment, specifically:

Source: Rapid Application Selection Framework, SoftwareReviews

A business impact assessment helps you find the actual pain points, identify capability gaps, and realize the needs and potential impacts on the business. Don’t start with the tool, start with the needs, gaps, and opportunities. Otherwise, you run the risk of implementing a truly unneeded tool without any hope of ROI.

Next, identify no more than five ultimate key stakeholders – business sponsor, IT lead, IT technical expert, process expert, and the business user. The more people and voices you get involved, the longer the process will take and the less satisfied users will be with the end product.

Phase 2: Education and discovery

You’re probably swamped, and chances are you’re catching up on evenings and weekends.

How can you squeeze in time to do market assessments? How do you sift through the noise of the market complexities, confusing websites, and clear vendor biases and messaging? Who’s the top player, what are their features and capabilities, and what is it truly like to be locked into a long-term contract with them?

The best decision you can make is to uncover vendor information from a wide array of trusted sources, leveraging third party sources for vendor information, application category information, and finally software landscape trends.

Find a trusted partner to aggregate key data and help you understand what these tools can do, what customers think of these vendors, and what their overall experience is like. This will also raise your knowledge of application and industry trends.

When searching for a trusted partner, avoid ones that operate on a pay-to-play review system, or who leverage market presence accelerant factors. Look for a partner that showcases crowdsourced and vendor-agnostic reviews, as this will provide you with a pure, unadulterated window of what real customers think about each particular vendor.

But don’t stop there – try to find other people, whether industry experts or peers who have also used this software or vendor and gather their thoughts and experiences.

Source: Rapid Application Selection Framework, SoftwareReviews

Phase 3 – Prioritize requirements & shortlist

You can’t make a shortlist if you have too many requirements. Identify the top five differentiating capabilities that meet your most critical needs that have a clear link to vendor differentiation, not just table stakes features.

At the end of the day, you won’t be able to meet every single requirement. So you must objectively decide which ones you absolutely need and which ones you can live without. If you have an extended number of requirements, consider using the MoSCoW model of Prioritization to narrow it down.

Source: Rapid Application Selection Framework, SoftwareReviews

Finally, use these requirements to conduct a data-driven comparison of vendor features and capabilities. Your goal here is to narrow the field to your top contenders.

Don’t just have a shortlist of the one vendor your friend told you about – a shortlist of one is bad, and likewise, so is a shortlist of 15. Ruthlessly prioritize your requirements so that you can narrow down a shortlist of four potential vendors or solutions.

Phase 4 – Align on a clear decision framework

First, be clear about your selection criteria. While your evaluation will still involve some “art” rather than science, your scoring model will help you objectively compare your shortlist.

Include criteria that make sense based on the complexity and type of tool, such as functional capabilities, affordability, extensibility, scalability, vendor viability, etc. And don’t forget to include relationship metrics as well.

Leveraging emotional responses from other end users can act as a strong indicator of a strong future client-vendor relationship.

From here, decide which of the four vendors make it to the demo phase, but evaluate on your terms, not on theirs. Craft your own use cases and evaluate how their solution can help solve your actual problems, not on how many features they may have.

Change the terminology from a vendor demo to an investigative interview, and ask for references. While they’re likely to offer references that will provide positive feedback, don’t be afraid to dig into the interviews to understand some of the limitations related to the solution.

After completing this phase, you should be able to get that shortlist down to two or three vendors.

Phase 5 – Negotiate to win

Once you reach this point, you need to keep your options open. You shouldn’t be negotiating with only one vendor or more than three. It’s perfectly fine to have a front runner, but if you’re only dealing with one vendor, you’re most likely losing out on a discount or other incentives.

Speaking of which, how do you deal with negotiations? Do you have a formal vendor management or procurement office? Do you understand all the fine print in the contract? How do you know that you’re getting the best price? If you can’t answer these questions, you may be at risk of signing an unfavourable contract.

Think about how many times your sales team has cut a deal or given a discount to close a sale. This is commonplace, so don’t get taken advantage of and leverage multiple proposals to your benefit.

Don’t sign a contract if you don’t understand the language or what you’re getting into. Vendors commonly place language in the contract that favours themselves in the long run – something as simple as a name change could allow contract renegotiation. You would call an electrician to repair a faulty system in your home. So do the same with your contracts and call a professional.

At the end of the day, going in without a plan is, well, going in without a plan. Our research shows that people who have a strong process for software selection end up with higher satisfaction with the end product. You’ll also need a plan for implementation, training, and onboarding, but we’ll cover those critical areas in a future article.

Selecting a new tool or software isn’t difficult, but the wrong decision can have long-term impacts on the marketing team and/or the business. Instead of jumping in blind, using gut-feel decisions and intuitions, start with a framework to accelerate and improve software selection.

Remember, a plan is better than no plan. Don’t get stuck.

Alan Neal is the Chief Growth Officer at SoftwareReviews, a leading player in the B2B technology review space. Alan focuses on helping end users make the right technology decisions while enabling sales and marketing teams to grow their technology businesses.